The Euro-Dollar pair is consolidating ahead of US employment data later in the week. The rhetoric from the Fed and the data over the last few months has some participants believing the FED may not hike rates in June. If this is confirmed by the data, the Euro may extend its gains, while strong data may see a bigger correction as the USD rallies. If the data is difficult to interpret, the indecision will increase and so will volatility.

The underlying trend is still bullish for the Euro, it’s just the size of the corrections that are uncertain.

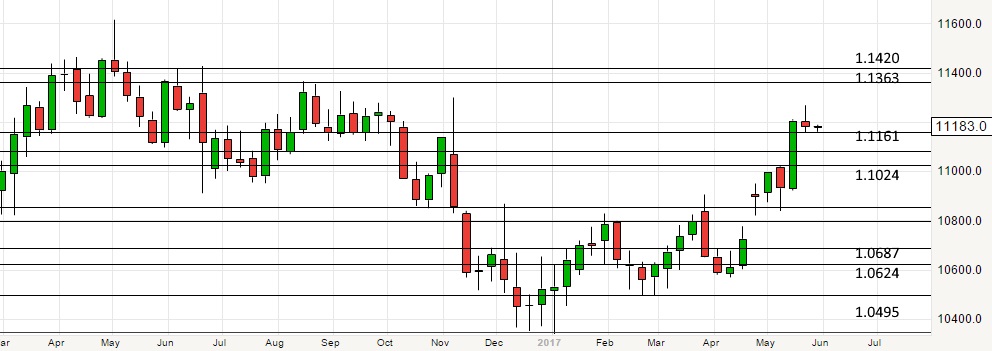

(EUR/USD Weekly Chart – A pause after a strong move)

In the short term, a break of either side of last week’s trading range is likely to lead to a modest move in the direction of the break.

(EUR/USD 4-Hour Chart – a tight range which could break in either direction)

For the complete analysis and strategy click here http://www.eurusd.co/analysis/consolidating-ahead-of-key-us-data-29-may-2017.html