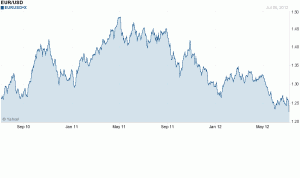

The euro fell to a two-year low against the US dollar on Friday after June 2012 Jobs report was below market expectations.

U.S. nonfarm payrolls report showed 80K jobs were added in June, less the 100K average forecast by economists. Despite the fact that the unemployment rate was unchanged at 8.2%, this was a disappointing report for the U.S. and the world’s economy.

U.S. nonfarm payrolls report showed 80K jobs were added in June, less the 100K average forecast by economists. Despite the fact that the unemployment rate was unchanged at 8.2%, this was a disappointing report for the U.S. and the world’s economy.

The weaker than expected U.S. jobs data came out only a day after the announcement of the interest rate cut by the European Central Bank, which increased USD momentum against the Euro as risk aversion strategy is being adapted by more investors.

With United State’s interest rates near zero, the change of monetary policy in Europe and China reducing the relative interest rate advantages held over the greenback, it’s no surprise that the USD is gaining more power over the Euro.

EURUSD currency pair closed under 1.2300 support level. The Euro’s short term support was seen 1.2288, while resistance is around 1.2500.